How To Avoid Paying Sales Tax On A Used Car In Texas . — how do i avoid paying tax on a used car in texas? You can try to buy in another state or city,. — the simplest way to avoid paying sales tax on a used car is to live somewhere that doesn’t charge it. learn how to calculate and pay sales tax on used cars in texas, and find out who is exempt from this tax. Here are your best options. You don't have to do. Unless gifted, a transfer of a vehicle is considered a retail. — if someone purchases a vehicle outside of texas and then brings it into the state, the purchaser must pay the new resident use tax or motor vehicle. there are a few ways that you can legally get out of paying sales tax on your new used car. — one of the easiest ways to avoid sales tax on a used vehicle purchase is to live in a state that doesn't charge sales tax.

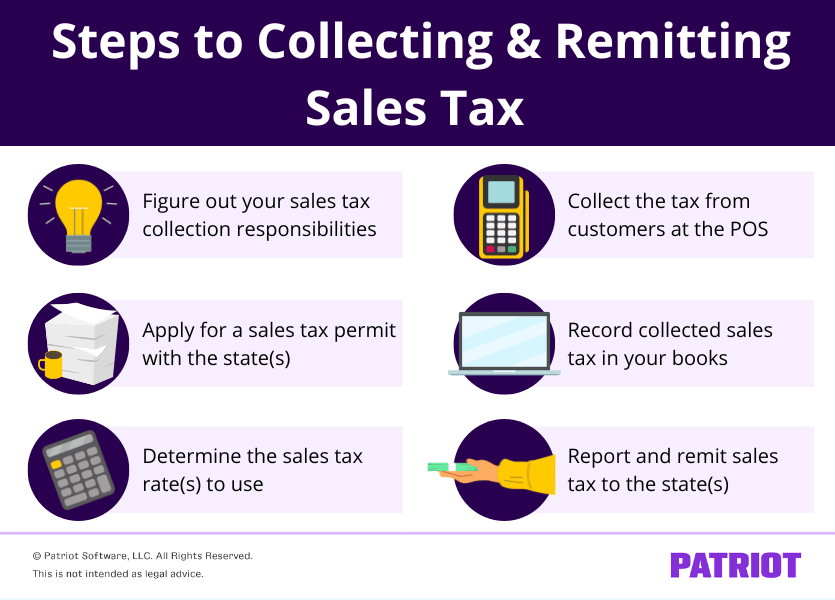

from www.patriotsoftware.com

You don't have to do. there are a few ways that you can legally get out of paying sales tax on your new used car. — one of the easiest ways to avoid sales tax on a used vehicle purchase is to live in a state that doesn't charge sales tax. — the simplest way to avoid paying sales tax on a used car is to live somewhere that doesn’t charge it. Unless gifted, a transfer of a vehicle is considered a retail. You can try to buy in another state or city,. learn how to calculate and pay sales tax on used cars in texas, and find out who is exempt from this tax. — how do i avoid paying tax on a used car in texas? — if someone purchases a vehicle outside of texas and then brings it into the state, the purchaser must pay the new resident use tax or motor vehicle. Here are your best options.

How to Pay Sales Tax for Small Business Guide + Chart

How To Avoid Paying Sales Tax On A Used Car In Texas there are a few ways that you can legally get out of paying sales tax on your new used car. — if someone purchases a vehicle outside of texas and then brings it into the state, the purchaser must pay the new resident use tax or motor vehicle. Unless gifted, a transfer of a vehicle is considered a retail. — how do i avoid paying tax on a used car in texas? learn how to calculate and pay sales tax on used cars in texas, and find out who is exempt from this tax. You can try to buy in another state or city,. You don't have to do. — the simplest way to avoid paying sales tax on a used car is to live somewhere that doesn’t charge it. there are a few ways that you can legally get out of paying sales tax on your new used car. — one of the easiest ways to avoid sales tax on a used vehicle purchase is to live in a state that doesn't charge sales tax. Here are your best options.

From marketbusinessnews.com

The Ultimate Guide to Sales Taxes for Small Business Owners How To Avoid Paying Sales Tax On A Used Car In Texas — if someone purchases a vehicle outside of texas and then brings it into the state, the purchaser must pay the new resident use tax or motor vehicle. Here are your best options. learn how to calculate and pay sales tax on used cars in texas, and find out who is exempt from this tax. Unless gifted, a. How To Avoid Paying Sales Tax On A Used Car In Texas.

From learningschoolodszycigw.z4.web.core.windows.net

Bill Of Sale Of Vehicle In Texas How To Avoid Paying Sales Tax On A Used Car In Texas — how do i avoid paying tax on a used car in texas? — the simplest way to avoid paying sales tax on a used car is to live somewhere that doesn’t charge it. You can try to buy in another state or city,. learn how to calculate and pay sales tax on used cars in texas,. How To Avoid Paying Sales Tax On A Used Car In Texas.

From myauctionsheet.com

How to Avoid Paying Sales Tax on a Used Car Automotive News How To Avoid Paying Sales Tax On A Used Car In Texas — the simplest way to avoid paying sales tax on a used car is to live somewhere that doesn’t charge it. You can try to buy in another state or city,. Unless gifted, a transfer of a vehicle is considered a retail. there are a few ways that you can legally get out of paying sales tax on. How To Avoid Paying Sales Tax On A Used Car In Texas.

From www.youtube.com

Difference between Use Tax and Sales Tax in the US YouTube How To Avoid Paying Sales Tax On A Used Car In Texas — the simplest way to avoid paying sales tax on a used car is to live somewhere that doesn’t charge it. You don't have to do. learn how to calculate and pay sales tax on used cars in texas, and find out who is exempt from this tax. Unless gifted, a transfer of a vehicle is considered a. How To Avoid Paying Sales Tax On A Used Car In Texas.

From www.carsalerental.com

Sales Tax Paid On New Car Car Sale and Rentals How To Avoid Paying Sales Tax On A Used Car In Texas Unless gifted, a transfer of a vehicle is considered a retail. — the simplest way to avoid paying sales tax on a used car is to live somewhere that doesn’t charge it. You don't have to do. You can try to buy in another state or city,. learn how to calculate and pay sales tax on used cars. How To Avoid Paying Sales Tax On A Used Car In Texas.

From printablethereynara.z14.web.core.windows.net

State And Local Sales Tax Rates 2020 How To Avoid Paying Sales Tax On A Used Car In Texas You don't have to do. Here are your best options. there are a few ways that you can legally get out of paying sales tax on your new used car. learn how to calculate and pay sales tax on used cars in texas, and find out who is exempt from this tax. — the simplest way to. How To Avoid Paying Sales Tax On A Used Car In Texas.

From privateauto.com

How Much are Used Car Sales Taxes in Indiana? How To Avoid Paying Sales Tax On A Used Car In Texas — how do i avoid paying tax on a used car in texas? Unless gifted, a transfer of a vehicle is considered a retail. — the simplest way to avoid paying sales tax on a used car is to live somewhere that doesn’t charge it. there are a few ways that you can legally get out of. How To Avoid Paying Sales Tax On A Used Car In Texas.

From tax.thomsonreuters.com

What is sales tax? How To Avoid Paying Sales Tax On A Used Car In Texas You don't have to do. Here are your best options. there are a few ways that you can legally get out of paying sales tax on your new used car. — if someone purchases a vehicle outside of texas and then brings it into the state, the purchaser must pay the new resident use tax or motor vehicle.. How To Avoid Paying Sales Tax On A Used Car In Texas.

From www.adamsinvestorgroup.com

You can legally avoid paying taxes Adams Investor Group Serving PA How To Avoid Paying Sales Tax On A Used Car In Texas — the simplest way to avoid paying sales tax on a used car is to live somewhere that doesn’t charge it. — one of the easiest ways to avoid sales tax on a used vehicle purchase is to live in a state that doesn't charge sales tax. learn how to calculate and pay sales tax on used. How To Avoid Paying Sales Tax On A Used Car In Texas.

From www.patriotsoftware.com

How to Pay Sales Tax for Small Business Guide + Chart How To Avoid Paying Sales Tax On A Used Car In Texas there are a few ways that you can legally get out of paying sales tax on your new used car. learn how to calculate and pay sales tax on used cars in texas, and find out who is exempt from this tax. — if someone purchases a vehicle outside of texas and then brings it into the. How To Avoid Paying Sales Tax On A Used Car In Texas.

From propertysolutionsnorthwest.com

5 Easy and Simple Ways For Avoid Sale Tax On Your Home How To Avoid Paying Sales Tax On A Used Car In Texas — one of the easiest ways to avoid sales tax on a used vehicle purchase is to live in a state that doesn't charge sales tax. learn how to calculate and pay sales tax on used cars in texas, and find out who is exempt from this tax. — how do i avoid paying tax on a. How To Avoid Paying Sales Tax On A Used Car In Texas.

From azexplained.com

When Trading A Car What Is Sales Tax? AZexplained How To Avoid Paying Sales Tax On A Used Car In Texas there are a few ways that you can legally get out of paying sales tax on your new used car. — if someone purchases a vehicle outside of texas and then brings it into the state, the purchaser must pay the new resident use tax or motor vehicle. You don't have to do. — one of the. How To Avoid Paying Sales Tax On A Used Car In Texas.

From printablemapaz.com

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas How To Avoid Paying Sales Tax On A Used Car In Texas — if someone purchases a vehicle outside of texas and then brings it into the state, the purchaser must pay the new resident use tax or motor vehicle. Unless gifted, a transfer of a vehicle is considered a retail. there are a few ways that you can legally get out of paying sales tax on your new used. How To Avoid Paying Sales Tax On A Used Car In Texas.

From www.slideserve.com

PPT Taxation Illustrating Classic Legal Environment and How To Avoid Paying Sales Tax On A Used Car In Texas — one of the easiest ways to avoid sales tax on a used vehicle purchase is to live in a state that doesn't charge sales tax. — how do i avoid paying tax on a used car in texas? You don't have to do. — the simplest way to avoid paying sales tax on a used car. How To Avoid Paying Sales Tax On A Used Car In Texas.

From www.cashcarsbuyer.com

If I Sell My Car Do I Pay Taxes? ️ All You Need to Know About Taxes How To Avoid Paying Sales Tax On A Used Car In Texas — the simplest way to avoid paying sales tax on a used car is to live somewhere that doesn’t charge it. — one of the easiest ways to avoid sales tax on a used vehicle purchase is to live in a state that doesn't charge sales tax. Here are your best options. — how do i avoid. How To Avoid Paying Sales Tax On A Used Car In Texas.

From www.regit.cars

5 Ways to Avoid Paying Tax on Your Car Regit How To Avoid Paying Sales Tax On A Used Car In Texas Unless gifted, a transfer of a vehicle is considered a retail. — the simplest way to avoid paying sales tax on a used car is to live somewhere that doesn’t charge it. You don't have to do. Here are your best options. — if someone purchases a vehicle outside of texas and then brings it into the state,. How To Avoid Paying Sales Tax On A Used Car In Texas.

From www.youtube.com

7 Ways To (LEGALLY) Avoid Taxes Tax Loopholes Of The Rich YouTube How To Avoid Paying Sales Tax On A Used Car In Texas — how do i avoid paying tax on a used car in texas? — one of the easiest ways to avoid sales tax on a used vehicle purchase is to live in a state that doesn't charge sales tax. there are a few ways that you can legally get out of paying sales tax on your new. How To Avoid Paying Sales Tax On A Used Car In Texas.

From myauctionsheet.com

How to Avoid Paying Sales Tax on a Used Car Automotive News How To Avoid Paying Sales Tax On A Used Car In Texas You don't have to do. learn how to calculate and pay sales tax on used cars in texas, and find out who is exempt from this tax. — how do i avoid paying tax on a used car in texas? You can try to buy in another state or city,. Unless gifted, a transfer of a vehicle is. How To Avoid Paying Sales Tax On A Used Car In Texas.